ESG, GHG, the drive to Net-Zero… the focus on climate change and the regulatory requirements to report on direct and indirect carbon emissions for insurance businesses of all sizes is an onerous task. Gamma LI – alongside partners at Sust Global and First Derivative – participated in an MGAA webinar to shine a light on the topic and provide some guidance. This blog covers some of the key points raised.

KEY TAKE-AWAYS:

- Guidance from regulatory authorities exists, but if help is needed, know that help is available – starting that journey might only be a conversation away

- Don’t fence yourself (or your business) in – climate risk models are evolving – make certain your approach allows for flexibility

- Collaboration with (data and analytics) 3rd-parties has the potential to be synergistic – alongside gaining the benefit of learnings from across other sectors that are further into their journey (ie. banking, investment, and retail)

You can watch this Webinar On-Demand

SESSION OVERVIEW:

Section 1: Assessing Environmental Property Risk

As is widely known, Insurance businesses of all sizes are coming under increasing pressure to report to their customers, investors, and regulatory/compliance agencies their plans in relation to mitigating their exposure to climate change impacts.

For a few their plans are thought through and under way.

For many this will be an onerous task, with paralysis impeding their first steps.

And for others the darkness of sand may only give temporary, soothing relief.

But it doesn’t have to be this way.

Data, technology, business processes and support in aligning to regulatory guidance – before it is mandated – are in abundance and can make these steps less arduous.

Whilst the topic of ESG is wide and varied, the focus for the webinar from Gamma LI, Sust Global and First Derivative is specific to the following:

- Environmental changes – or the “E” in ESG

- The impact on property – whether the property is commercial or residential

- The impact of climate change specific to property

- The onus placed upon underwriting operations to streamline reporting, and

- How technology and data can provide practical assistance in achieving current – and evolving – business requirements.

If none these impact your business, then you can probably save yourself some time.

But if any of these elements are important, then please do read on.

Or get in touch.

The irony is that more organisations are perhaps further along the path than they imagine.

If you are a commercial or residential property insurer, MGA, or investor then you may either have access to or are considering the capture, use, and application of property data in your decision-making process.

As such, so far, good news.

And if it’s in a digital format – even better.

This alone provides the foundation against which climate change impacts on property can be mapped – or appended – or enriched.

However, from an ESG-drive-towards-Net-Zero and subsequent reporting perspective the types of climate change related impacts to property are three-fold:

- Physical risk – environmental perils and changes arising due to climate change (increased flood, etc.)

- Transition risk – risks associated with implementing a low-carbon policy in relation to your businesses property portfolio, such as retrofit cost, loss of value

- Liability and Regulatory risk – the impact of the emissions coming from properties and the businesses exposure to legal implications.

Clearly this is where things can start to get challenging.

Or dare I say overwhelming.

Of course, there are always options – you could ignore it and suffer the consequences – or you could embrace it, take mitigating action, and transition the business (in any number of small ways) to ensure future exposure is reduced.

It is broadly understood that physical climate change risks are escalating:

- They are geographically wider – risk zones are expanding

- They are – and will be – more severe

- They are – and will be – more frequent

- The financial implications more onerous and far reaching, and

- The regulatory reporting and actions required are – and will be – more rigorously applied to ensure commercial activities are supportive when it comes to reducing emissions.

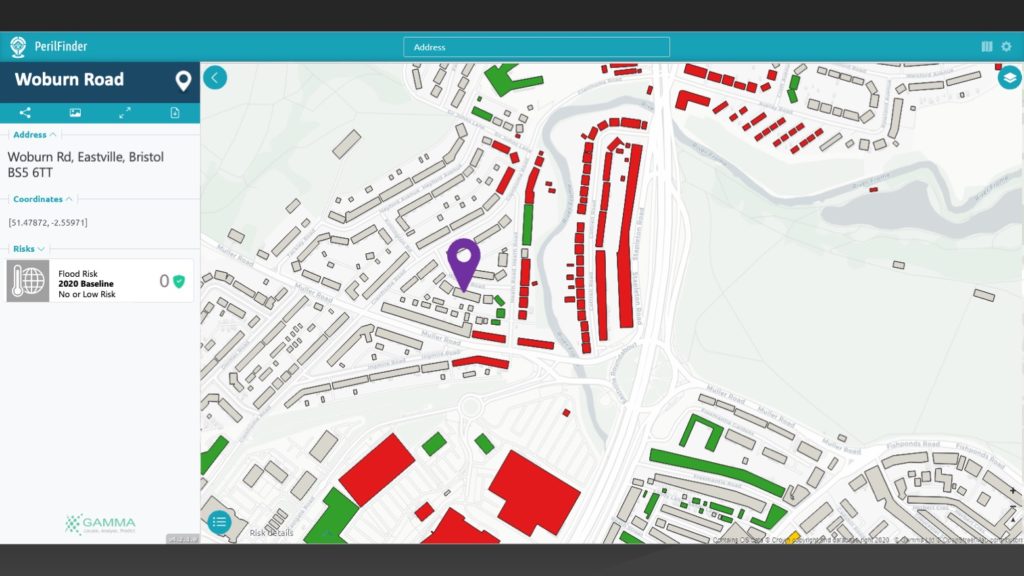

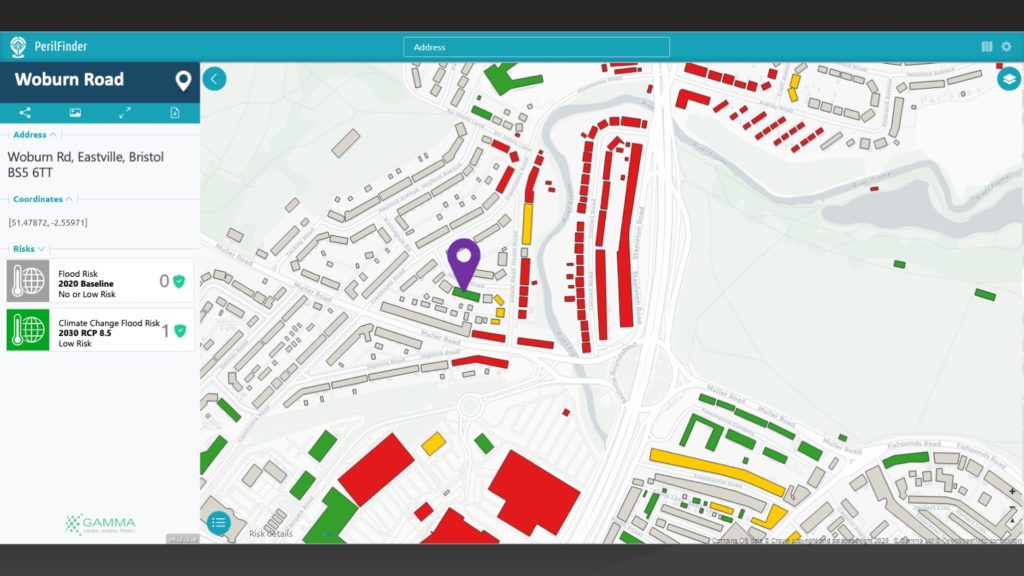

Image 1: The gradual creep of increased risk exposure – the transition over time of an area of low current risk, to high future risk – focused on the projected impact of property flooding (projected transition from 2020 to 2080).

But what does that really mean – well perhaps some numbers can provide context:

Gamma LI analysis in collaboration with Ambiental Risk Analytics:

1.3 million additional properties by 2050 – of course it’s easy to say that is ages away, but to provide some context for how that might look year-on-year for the next 30 years, then (if it were linear… and it won’t be) that’s an additional 45,000 properties (and potential claims) every year for the next 30 years.

If an average claim were £10,000 then that would be an annual bill of £450m every year.

Or £13.5 billion over the next 30 years.

Talk about flushing money down the drain.

Of course, this is a linear extrapolation and not necessarily a true reflection, but hopefully it paints a picture.

But we know it’s hard.

Many organisations are still reticent to the perceived need to report on environmental risks – which are conceivably the easier ones to report on.

Add in the need to account for risk associated with transition, liability, and regulatory demands – it’s no wonder that many in the insurance industry (big and small) are overwhelmed by what is needed.

Or indeed where to simply start. Especially as the level of investment is not insignificant – and the number of options on what to invest in are multi-various.

Our advice – perhaps not unsurprisingly – is to back a partner that is agile, flexible, and able to customise and grow as business needs evolve.

And as the demands placed upon you by regulation evolve.

A few insurers are taking responsibility and leading the way – these are the bigger brands who (it may be argued) can afford to do so. They have embraced the guidance that has been published to date [see “Expanding Property Risk Platforms To Assess Climate Change Impacts – Resources” blog for reference material].

But the environment and the impact that we have upon it is our joint responsibility.

One we all need to act on.

In summary:

- Insurers and MGAs need to analyse, report, and take mitigation on those physical risks that climate change presents:

- Whether that is at an individual property level or for an entire portfolio of property (book of business)

- As well as monitor and report on green-house gas (GHG) emissions by ingesting environmental performance certificate (EPC) and open-source data

- Alongside modelled estimates

But in terms of advice: If help is needed, know that help is available – starting that journey might only be a conversation away.

If your ambition matches ours, we have the experience and capability to assist.

At the pace and sophistication (or otherwise) that your immediate needs require.

Image 2: The capability to report and monitor progress is just a conversation away.

N.B.:

For additional detail on GLI’s data and technology watch the session from around 19-mins in.

Section 2: Understanding the Current State of Development of Climate Risk Models

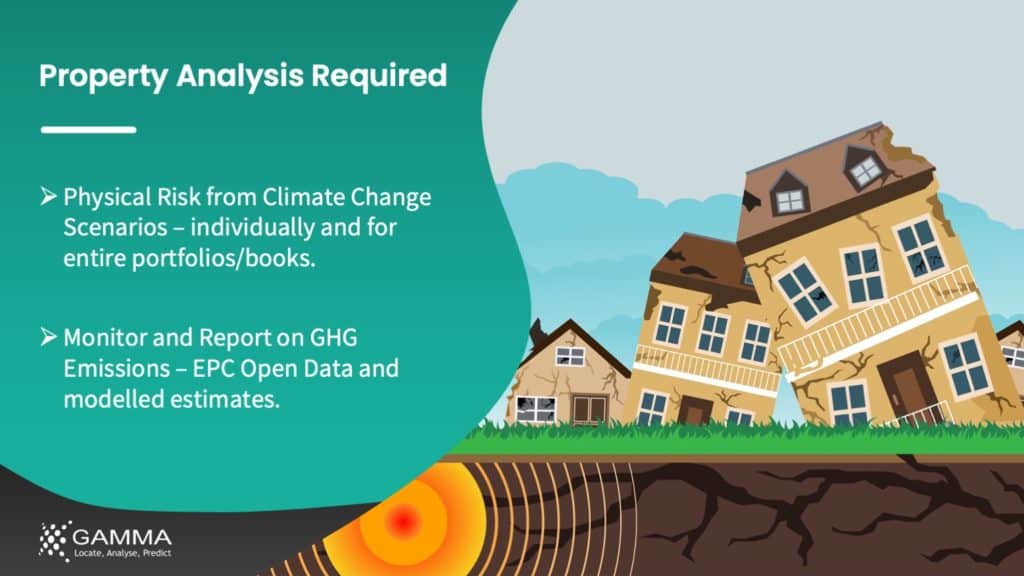

Physical climate risk assessment requires different data inputs in order to illustrate what impacts may transpire from a climate change perspective at a local level.

Big global climate models are meant for scientific, rather than for business use. So they require addition inputs and analysis:

- Geo-spatial data to augment and extrapolate geographically,

- Asset location data to pinpoint where impacts may be felt and

- Financial appraisal data to enable the measurement and implications of impacts on the asset (or multiple assets) under assessment.

Image 3: Data inputs for climate risk analysis.

So, manipulation, data enhancement, and modelling are required to make the data more meaningful for business assessment, appraisal, and planning.

The whole process of taking multiple sources and making them useful for business purposes is termed “business intelligence ready climate risk data”.

However, perhaps the greatest challenge with climate change is that its impact is not linear.

It is easy for us to see dates that are 20 or 30 years into the future and deem the concern to be far enough away not to have an immediate concern.

But as we’ve heard from many sources, it is the sustained financial impact that climate change is delivering and will continue to deliver into the future that insurance and investor markets need to be concerned about today.

And need to act on now to address and ensure that business is sustainable tomorrow.

Especially on large portfolios of assets – be they global or regional.

The interruption to business could – in some cases – be totally catastrophic.

Of course, this is an evolving science.

Some models are good, some are bad, some have gaps, some lack coverage, some have weaknesses, some require investigation and work to make then useable.

Not necessarily messages that businesses want to hear when trying to use data that could fundamentally change the way they operate.

Therefore, it is important that the use of such data is clearly understood – like any data, its use is advisory and guiding.

But to ignore it could be massively detrimental.

Section 3: Next Generation Pricing, Valuation, and Risk

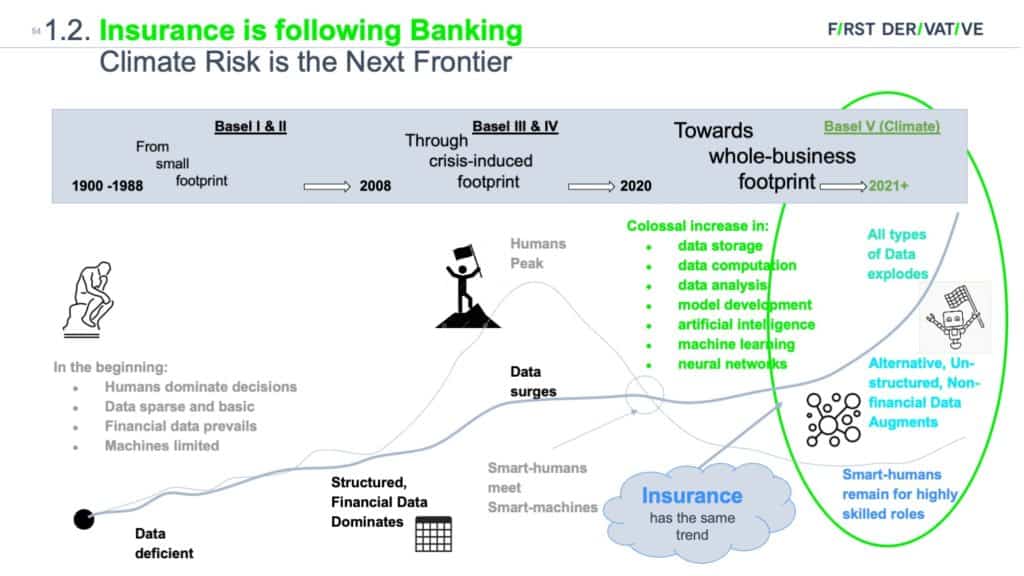

Insurance can and should take its lead and learning from the banking sector – which is perhaps a little further down the line in taking the leap with regards to using climate related data to transform its business processes and practices.

As such we see convergence in the interests of banks, insurers, and investors – especially in terms of the data needed to enable business to operate.

Whilst tradition in insurance has seen data consumed by an individual to make decisions, (like the banking sector) this will change to the data being consumed technologically and presented in a way that aids the decision – consistently, accurately, timely, and at scale.

Visualisation tools will enable the interpretation of data – in fact they enable this already – users/businesses need to get onboard.

Image 4: Insurance should take its lead from the Banking sector.

What risk problems are we trying to solve?

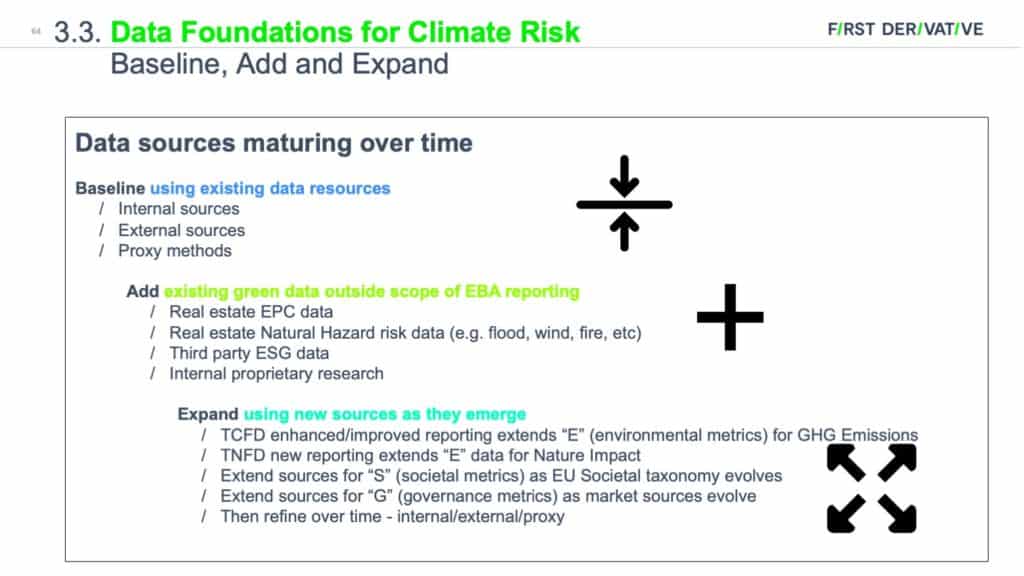

Primarily we are trying to take structured financial data (traditional data) and combine it with climate data that is unstructured and non-financial in nature.

One of the biggest disparities between these data types is in terms of the time horizon:

- Traditional data tends to have a short (1 day to 1 year) time horizon, whereas

- Climate risk modelling is longer term (10-year to 100-years)

Therefore, there is a need to bridge that gap, but the challenge to be aware of is that in doing so you introduce model risk and sensitivity – and the danger of increased pricing error.

As such organisations need to apply an agile approach – whereby they re-evaluate and learn over time and make adjustments to enable better pricing capability when taking projected climate risk data into account.

What are the new frameworks?

Sadly, there is no definitive answer.

But Insurers/MGAs need to start thinking about this – make a start, accept it will evolve, roll with the punches, and work collaboratively with a partner who can interpret your data/analytics/reporting needs and support you through the inevitable changes.

But most important of all… make a start.

The key is to remain dynamic… flexible… agile.

Image 5: Data is evolving – the advice is to collaborate with a flexible and agile solutions provider.

@ 2022 Gammali.co.uk by Jason Day

About Gamma Location Intelligence

Gamma Location Intelligence (Gamma LI) is a cloud hosted solutions provider that integrates software, data and services to help our clients reduce risk through location intelligence. Established in Dublin, Ireland in 1993, and with offices in Manchester, UK and Bilbao Spain, the company has expanded to become a global provider of cloud-native location intelligent systems and services. Gamma LI’s Perilfinder™ risk mapping platform provides property underwriters with access to trusted property-level risk data easily, quickly and accurately.