Gamma Location Intelligence partners with MetSwift to add wind, rainfall and temperature models to their peril data portfolio for Great Britain & Ireland.

Gamma Location Intelligence (LI) is pleased to announce that it has recently entered into a partnership with MetSwift. Gamma LI, the location intelligence company, is continually adding new datasets to enhance its risk assessment portfolio for Britain and Ireland. This new partnership will give Gamma LI’s customers access to MetSwift’s parametric weather risk insights through its Perilfinder™ platform.

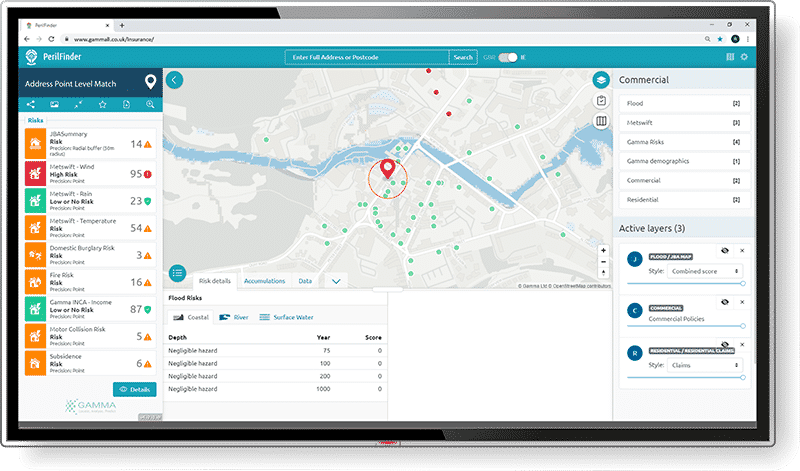

Gamma LI’s Perilfinder™ is the location-intelligent platform of choice when identifying property risk is critical. This cloud-hosted risk-mapping platform helps insurers, MGAs and lenders to reduce their risk profile through sub-second property-level RAG scoring and through better management of their policy accumulations. Perilfinder™, which delivers trusted property-level risk data simply, quickly and accurately, now incorporates MetSwift’s advanced proprietary model for three distinct risk types: wind, rain and temperature.

MetSwift uses AI and meteorological data to build wind and rainfall models. Having developed a number of models for the UK, MetSwift have recently added new models for Ireland. Now Gamma LI’s customers can instantly view the probable maximum weather risk, which is based on the type and severity of the weather. MetSwift’s wind and rainfall risk scores are adjusted locally and take into account the impacts of climate change specific to each weather type. MetSwift’s risk information is also presented along with specific predetermined thresholds, making it suitable for gaining an understanding of parametric risk and for developing parametric insurance products.

Describing the partnership between Gamma LI and MetSwift, Richard Garry, Chief Commercial Officer of Gamma LI, explained: “Accuracy, consistency and being a one-stop-shop for property-level risk data have always been at the top of our agenda. The partnership with MetSwift helps us with these goals. In the last few years, we have rebuilt Perilfinder™ using serverless AWS infrastructure and the latest vector mapping technology. The system utilises new datasets from the Ordnance Survey and other sources to provide building-level attributes. We have incorporated the latest risk data from JBA Risk Management, Ambiental Risk Analytics and the British Geological Survey. We developed a crime model for burglary and arson and are delighted to incorporate MetSwift’s powerful data into our platform.”

“Climate change is also a big area for us,” Richard Garry continued. “MetSwift’s evidence-based assessments will significantly aid the processing of weather-related claims and allow underwriters to quantify risks due to the ever-changing climate. MetSwift’s advanced weather model will allow insurers to understand the sensitivity of risks to weather limits, which in turn, will allow them to assess weather risk accurately, thus enhancing the consistency of their quotes.”

James Banasik, Chief Executive Officer, MetSwift, stated: “Displaying MetSwift’s weather and climate information in a visual way helps describe weather risk spatially; especially important in the context of climate change. Combined with topographic data and the other property or location-based datasets at Gamma LI’s disposal, augmenting our weather risk data with Perilfinder RAG scoring system will provide new industry insights in response to the non-uniform weather cycles, the non-linear nature of climate change and its impact upon industry risk profiles.”

@ 2021 Gammali.co.uk by Monika Ghita

About Gamma Location Intelligence

Gamma Location Intelligence is a global provider of cloud-hosted, spatial and geographic information systems. We integrate software, data and services to help our clients, which include insurance companies, to reduce their risk by providing location intelligence solutions. The company’s headquarters are in Dublin, but we have offices in Manchester in the UK and Bilbao in Spain. Perilfinder™ v.4.0, Gamma LI’s risk mapping platform, is a leading-edge property-level underwriting solution used by P&C insurers to assess environmental risks. The platform incorporates rooftop-level geocoding, map visualisations, risk and accumulation scoring and spatial peril models, including flood, subsidence, fire, and crime.

About MetSwift

MetSwift is a UK leading and award-winning independent global weather provider; a privately owned company which started out in sport event forecasting for major global events. The company has since diversified into the longer-term aspect of meteorology, using its experience in forecasting to work with clients on long-term weather campaign basis. The company deliver real time, accurate and long-range weather data to the world.

MetSwift utilises the disciplines of meteorology and mathematics, using trend analysis combined with past, present and forecasted weather data, to provide its customers with insight up to 5 years into the future. Every business is weather sensitive, either directly or indirectly, therefore access to accurate weather information as far in advance as possible can make our clients more profitable by mitigating against risks, saving costs, saving time, increasing visibility and hence profits. Businesses are becoming increasingly aware of the value of ‘weather intelligence’. MetSwift has built a market leading AI platform, unrivalled in the market, providing key differentiators which makes working with us advantageous in many ways.

MetSwift was declared as the award-winner for ‘Best use of AI in Underwriting’ by Insurance Times Tech & Innovations Awards 2019. Our AI-enhanced weather insight is regarded as the ‘potential game-changer for underwriting weather risks’.