What is Parametric Insurance?

Have you ever taken out parametric insurance? No, well maybe you have and you were oblivious to the fact. If you’ve ever had a bet with a bookmaker on the occurrence of a White Christmas, you were engaging in a form[1] of parametric insurance. Estimating the probability of the occurrence of an event, often weather-related, is at the core of this approach.

As climate change impacts make weather related events more frequent and severe, we may need to consider the scope of the traditional insurance indemnification model and perhaps consider alternative approaches such as parametric.

In traditional insurance, in the event of a loss, the insurer agrees to reimburse you for the cost of the damages incurred. In parametric insurance, the insurer makes a pay-out based on the event itself, instead of compensating for the damage which might be caused. This allows payments to be made more quickly as the process of loss assessment is removed and only verification of the event occurrence is required.

It also allows coverage where the likelihood of some damage occurring is high, as in parametric insurance the customer can stipulate the level of event to be covered and get a relevant premium.

A parametric insurance policy provides a pay-out immediately following the occurrence of a pre-defined event. In general, the customer defines the event that they want to insure against e.g. flood damage to a home or a sustained drought in agriculture. A trigger point is defined to stipulate that the event has occurred to the required level e.g. a river water height value recorded in official records. Once the agreed trigger level is reached at any time, the customer is paid. They do not have to prove that any damage has been incurred.

The process for all parametric policies is very similar to this but with different levels of complexity depending on what is being measured.

Where does it come from and how has it developed?

Parametric insurance is not a new concept, with even some origins in ancient bottomry contracts. In these, when a merchant was granted a loan for a voyage, they could pay an additional fee so that in the event their ship was lost, the loan was cancelled. The loss event effectively triggering the loan cancellation.

In more recent times, parametric insurance has been availed of mainly by Governments and NGO’s to cover extreme weather events on behalf of an entire community or State. An example of this is The Caribbean Catastrophe Risk Insurance Facility which uses parametric cover to offer rapid relief to Caribbean governments after cyclones, earthquakes and other extreme weather events. Payment is made following recording of weather events above specified trigger points. This allows for rapid access to much needed rebuilding funds for the islands without the painstakingly slow need to assess individual losses incurred at the property level.

Another example in Africa, is the ARC Insurance Company, which manages parametric insurance for the member states to provide cover for droughts and crop failures. This allows rapid pay-out of funds to member states from the risk pool to support humanitarian relief activity.

What are the benefits of parametric insurance?

In essence there are four key benefits that parametric offers over traditional insurance.

1. It Extends the Scope of Traditional Insurance to Cover Higher Probability Events

Parametric insurance can work in tandem with traditional insurance to insure risk that was previously viewed as uninsurable. The growing, global protection gap is a major issue within the world of insurance. Flood cover, for example, is becoming more and more difficult to cover. For those at risk, or who have been previously hit by catastrophe, traditional insurance may only offer prohibitively expensive premiums or in many cases no cover at all. By insuring against the likelihood of an event happening as opposed to the damage it causes, parametric insurance reduces the cost and uncertainty. It also enables those who have previously been excluded to get at least some level of cover, to soften the impact of the most damaging events.

2. It Speeds ups, Quantifies and Simplifies the Claims Process for the Insurer and the Insured.

With traditional insurance policies, customers often don’t receive a pay-out until a loss adjustor assesses the damage to the property and its contents. On top of this, there is the challenge of defining what is covered post-event to determine what the insurer will cover. A parametric insurance policy uses a pre-agreed pay-out tied to a highly specified trigger event so there is no haggling when a claim is made. This makes the claims process quicker and far more transparent. It’s also possible to set triggers to warning data so that payouts can be made before the event occurs. In a flood event, for example, this may allow the policyholder to finance protective measures reducing the overall impact.

3. It Offers Flexibility In Use of Funds to the Customer

As parametric pay-outs aren’t directly attached to damages, there are often very few restrictions on how the customer uses the money, meaning it can be used on unforeseen or consequential costs that traditional insurance doesn’t factor in. This can include paying for protective measures to reduce the impact of the event before it occurs. Having available funds immediately after an event, can be the difference of survival or destitution in some events, so in this regard parametric offers huge benefit.

4. It Offers Lower Costs and Certainty to the Insurer

The administrative costs for traditional insurance are greater as they incur costs that parametric insurers don’t. These can include costs for loss adjustors, claims teams, legal support or other costs. Traditional insurance is also exposed to much more uncertainty. It’s impossible to know the full cost of an event ahead of time and this uncertainty is often reflected in increased premiums. Parametric payouts are based on a fixed agreed amount, so there is far less uncertainty ahead of a claim. It also allows insurers to have a clear view of their exposure immediately after an event.

So, is it just for Governments and NGOs to avail of?

In the past, the main users of the parametric model have been Govts and NGOs often acting collectively. But this is changing, and we are seeing more and more companies emerging with parametric products for individual policyholders. Larger providers such as Swiss Re and AXA are offering parametric products covering earthquake and drought events respectively. In addition, a host of smaller niche companies are offering custom parametric cover including;

1. FloodFlash – who were the first UK company to engage in Parametric Flood Insurance using flood height sensor detection software (IoT) to offer property level parametric flood cover to UK households and businesses. Sompo are now providing a similar product in Japan.

2. Jumpstart Recovery – who provide parametric earthquake insurance.

3. World Cover – who protect farmers against loss of yield by offering parametric insurance using satellites to monitor rainfall triggers.

4. Blink Parametric – offering solutions for Climate, Travel, Energy, using IoT for the latter.

Why is Parametric becoming a more popular approach?

There are several reasons for this growth:

1. Improvements in Location Intelligence technology and Environmental Data accessibility

2. The growing, global protection gap. This has resulted in more and more cases of uninsurable risk that parametric insurance may offer a solution to those refused cover.

3. Investors have recognised its potential, rapidly increasing their investment in the technology and spawning many new operators.

How does the rise of Location Intelligence Technology facilitate Parametric’s Growth?

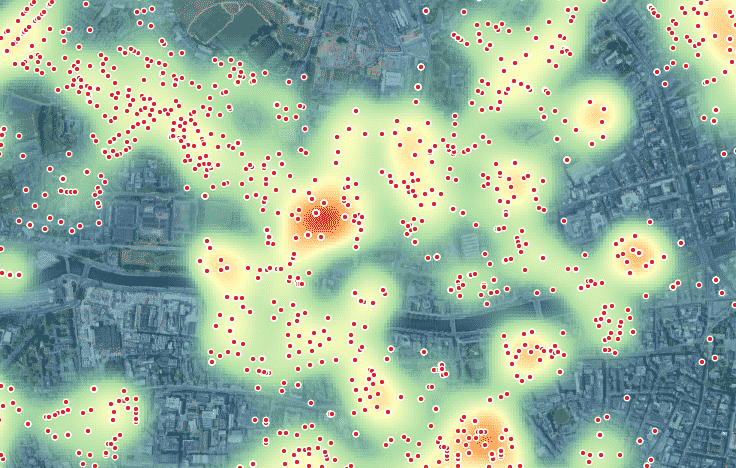

Location Intelligence (LI) technology is at the core of most applications of parametric, where environmental perils are the trigger points. The rapid improvement in LI has allowed parametric to develop rapidly and it can be explained in five key areas;

1. There’s far more environmental data available and a lot of it is open. This allows for easy access to environmental trigger data such as weather data, earthquake reports, flood alerts etc. Most of this is available through readily accessible APIs and digital data. Satellite data also has become much more accessible and affordable including the masses of data available through sources such Copernicus, NASA’s Global Flood Monitoring System and the OpenQuake Platform.

2. Models are more predictive with Location Intelligent AI. The rise of AI has driven better modelling and opened up possibilities to predict the likelihood of almost any event occurring. The predictive challenge, however, remains to keep track of our rapidly changing climatic patterns but we have the tools to do this.

3. Constantly Improving Cloud-Based Computing. This means the huge computations required to keep track of millions of trigger points and their connection to policyholders can be made in near real-time at realistic cost levels.

4. IoT Sensor Technology is readily available. Some environmental parametric products require IoT sensors to record environmental conditions (such as flood water levels) at the insured property. The affordable availability of these devices, and the LI technology behind their monitoring, has supported this growth.

5. Property Identification and Geocoding has Improved. With better property level data and geocoding engines along with coordinate-based postcode systems (such as What3Words) now widely available, the ability to accurately assess parametric risk for a risk address is now much more feasible.

What are the barriers to its implementation?

Parametric would seem to offer complimentary and very logical benefits to supplement traditional insurance. So why has it been slow to develop?

1. Legal Uncertainty and Complications – Parametric faces considerable regulatory barriers in many jurisdictions. Its pay-out system, where no loss needs to have been incurred, is contrary to some fundamental insurance regulations (the indemnity principal) and parametric products may need special exemptions in the relevant legislation, for example, to provide flood cover where none would otherwise be offered. It is also possible, in many jurisdictions, to execute parametric cover as a derivative, where the normal insurance contract requirement of a proof of loss is not required.

Some parametric companies are already operated out of favourable jurisdictions where the approach is permitted. For example, the African ARC Insurance Company is operated out of Bermuda “until such time that an equally favourable legal and regulatory regime exists in an AU Member State”.

2. Consumer Uncertainty – If trigger parameters are not met, it is possible that the policyholder is not paid out for loss sustained. This is referred to as the Basic Risk. This may deter potential consumers with the option of traditional cover from availing of the parametric option.

3. Market Inertia – insurance is a traditionally conservative sector and often moves slowly. Traditional insurers may be slow to adopt new parametric models.

The Future

Parametric insurance, enabled by rapid developments in location intelligence and driven by changes in environmental risk levels, will undoubtedly become more and more relevant in the coming years and decades. It allows policyholders to cover consequential losses in a much less complicated model. For example, the shipping company can cover for loss of business due to unusually low river levels reducing load capacity, the coffee farmer for unexpectedly low temperatures halving yields. The losses may not be a total interruption but enough of an impact to seriously impact on business. A parameter-based cover allows this flexibility to the customer where a loss based one never could.

Even the current Covid-19 pandemic would also potentially fit into a parametric model. In 2018, Marsh and Munich Re launched a parametric product, Pathogen RX designed to protect against the economic impact of infectious disease outbreaks, targeted at the hospitality and sporting event market. Undoubtedly, current contentious litigation could have been avoided with the clarity of defined trigger points.

Most insurers want to reduce the complexity of taking out cover. They also aim for quicker, less complicated pay-outs and better visibility of exposure to loss events. Parametric insurance offers all of these and is an attractive supplement to traditional insurance. It doesn’t seek to replace it but merely to offer choice, especially where potential losses are probable or ambiguous.

All in all, it seems likely that, subject to the necessary changes in legislation, parametric products are here to stay and will enhance market choice in the coming years.

Odds on a White Christmas?

@ 2020 Gammali.co.uk by Feargal O’Neill

About Gamma Location Intelligence

Gamma is a cloud-hosted solutions provider that integrates software, data and services to help our clients reduce risk through location intelligence. Established in Dublin, Ireland, in 1993, the company focuses heavily on leading-edge R&D including spatially aware AI and machine learning. Gamma has grown to become a market leader in the provision of location intelligence systems and services. Perilfinder™ v.4.0, Gamma’s risk mapping platform, is a cloud-hosted property-level risk assessment tool for sub-second assessment of environmental risk. Building on its market leading position across the island of Ireland, Perilfinder™ has recently extended its innovative platform to include the UK through partnerships with the major risk data providers.

[1] Of course, the absence of an exposure and thus an insurable interest would technically differentiate this gambling from parametric insurance.